The Ultimate Guide to Built-In Shelf Lighting

Explore guide to built-in shelf lighting. Learn about LED strips, puck lights, recessed lights, tape lights, and their installation tips for perfect ambiance.

The LED (Light Emitting Diode) lighting market includes all products and technologies that are related to the use of LEDs as a light source. LEDs are light-emitting diodes – semiconductors that emit light when an electric current is applied to them. LEDs are more energy efficient, durable, and last longer than traditional lighting technologies like incandescent or fluorescent lights.

The primary purpose of this report is to provide a detailed and comprehensive analysis of the global LED lighting market. The report aims to present an in-depth understanding of the market dynamics, including current trends, growth drivers, challenges, and opportunities. It also seeks to analyze the competitive landscape and provide strategic insights for businesses looking to enter or expand in the LED lighting market.

The analysis is based on data collected from reputable sources such as market research reports, industry publications, company annual reports, and government databases. Quantitative data has been analyzed using statistical tools to provide accurate market forecasts.

The LED lighting market has grown exponentially over the last 10 years. Several trends have driven this growth. Technology has moved the LED lighting market forward with more efficiency, better light quality, and longer life.

Continuous innovation, smart LEDs, and IoT integration have expanded the applications of LED lighting, making it more versatile and attractive for many uses.

At the same time, the cost of LED products has come down due to economies of scale, manufacturing process improvements, and increased competition. This has made LED lighting more accessible to a wider range of consumers and businesses and has accelerated adoption.

Government regulations and incentives have been key to promoting energy-efficient lighting. The European Union’s Energy Performance of Buildings Directive and the US Department of Energy’s initiatives have driven LED adoption. These regulations set strict energy efficiency standards and offer financial incentives to consumers and businesses to switch to LED lighting.

And awareness about the environmental impact of traditional lighting technologies has driven the shift to more sustainable solutions. LEDs have a lower carbon footprint and no mercury, making them the eco-friendly choice for modern lighting. This combination of technology, economics, regulation and environment will continue to drive LED growth and adoption globally.

The LED lighting market can be segmented based on various criteria, including product type, application, and region.

The market is highly competitive, with key players such as Signify (Philips Lighting), Osram, Cree Lighting, GE Lighting, and Acuity Brands dominating the landscape. These companies are focusing on innovation, strategic partnerships, and geographic expansion to maintain their market positions.

As of 2022, the global LED lighting market is valued at approximately USD 78.24 billion. This value represents the total market revenue generated from the sales of LED lighting products across various segments and regions.

The market is expected to grow at a CAGR of 19.2%, from USD 87.10 billion in 2023 to USD 298.38 billion by 2030. This growth is driven by increasing demand for energy-efficient lighting solutions, technological advancements, and supportive government policies. This robust growth can be attributed to several factors:

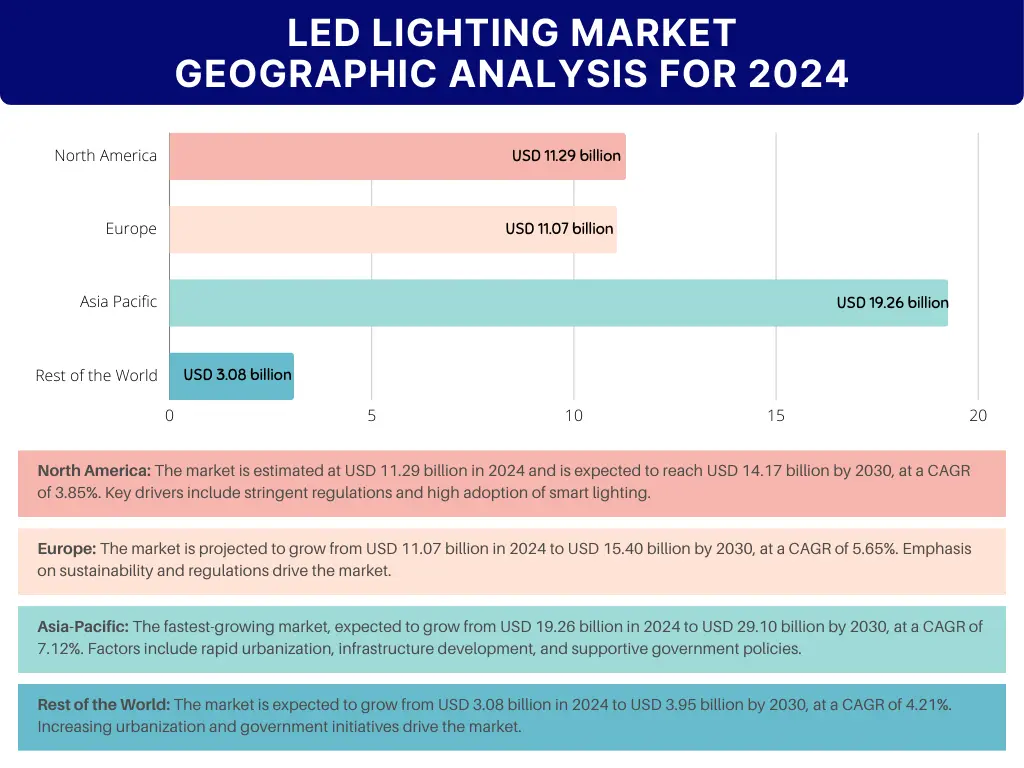

The geographic analysis of the global LED lighting market provides insights into the market size, growth trends, and opportunities across different regions. This section will examine the key regional markets, including North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Each regional analysis will cover market size, key trends, growth drivers, challenges, and growth opportunities.

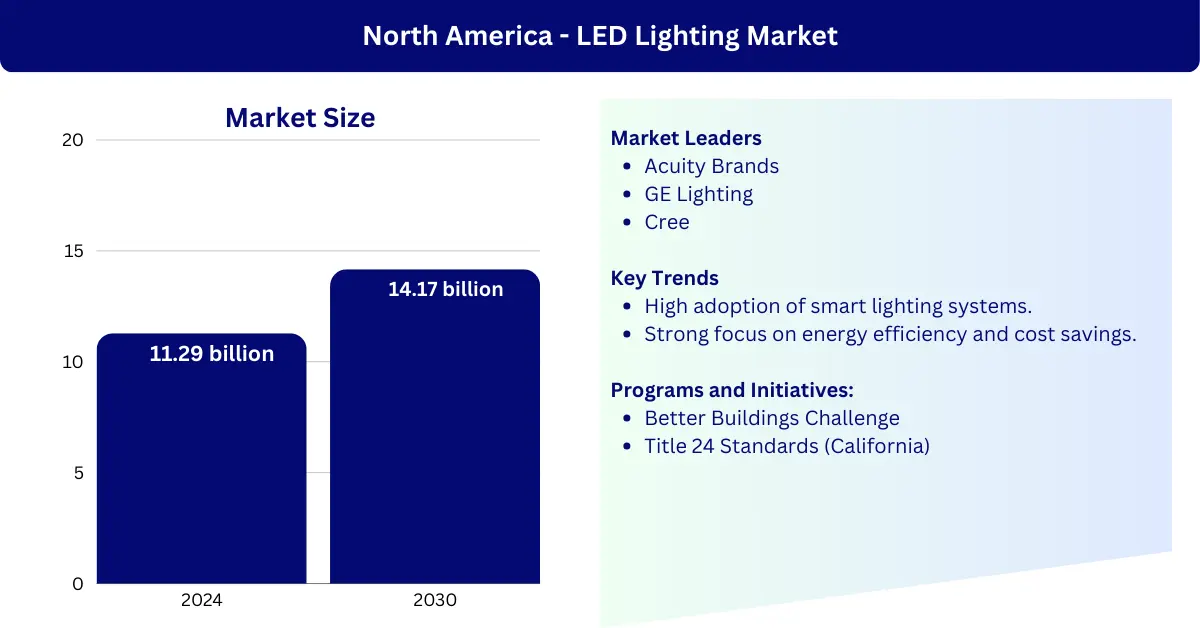

Market Size (2024): USD 11.29 billion

The North America LED Lighting Market size is estimated at 11.29 billion USD in 2024, and is expected to reach 14.17 billion USD by 2030, growing at a CAGR of 3.85% during the forecast period (2024-2030).

The North American LED lighting market is experiencing robust growth, driven by stringent energy efficiency regulations and high adoption rates of smart lighting systems. The U.S. Department of Energy’s initiatives, such as the Better Buildings Challenge, have been instrumental in promoting energy-efficient lighting solutions.

These programs encourage commercial and residential sectors to adopt LEDs to reduce energy consumption and operating costs. Additionally, state-level incentives, such as California’s Title 24 Building Energy Efficiency Standards, mandate energy-efficient lighting in new constructions and retrofits, further boosting the demand for LEDs.

The retrofit market is particularly strong in North America, with numerous projects replacing outdated lighting systems in public infrastructure, commercial buildings, and residential areas.

Leading players like Acuity Brands, GE Lighting, and Cree dominate the market, offering a wide range of innovative products that cater to the region’s growing demand for energy-efficient and smart lighting solutions.

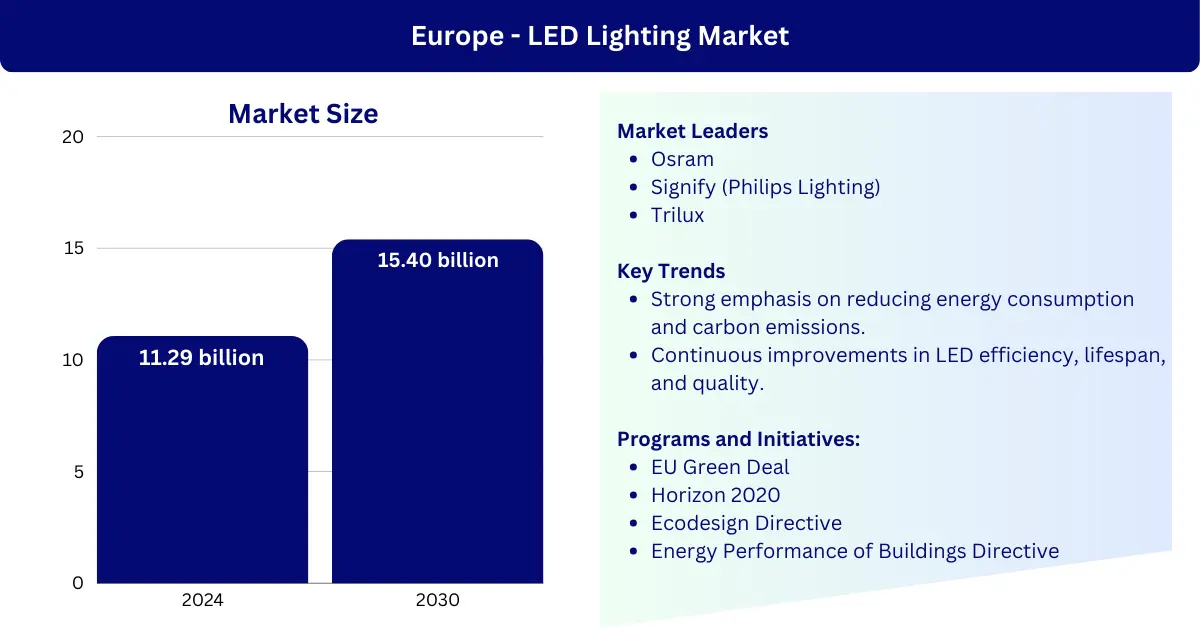

Market Size (2024): USD 11.07 billion

The European LED Lighting Market is projected to grow from 11.07 billion USD in 2024 to 15.40 billion USD by 2030, with a compound annual growth rate (CAGR) of 5.65% during the forecast period (2024-2030).

Europe’s LED lighting market is characterized by a strong emphasis on sustainability and stringent regulatory frameworks aimed at reducing energy consumption and carbon emissions. The European Union’s Ecodesign Directive and Energy Performance of Buildings Directive set high standards for energy efficiency in lighting products, driving the widespread adoption of LEDs.

Programs like the EU Green Deal and the Horizon 2020 initiative provide funding and incentives for energy-efficient technologies, including LED lighting. These regulations and incentives have accelerated the transition from traditional lighting to LEDs in both residential and commercial sectors.

Additionally, European consumers and businesses are increasingly aware of environmental issues and prefer sustainable lighting solutions. Companies such as Osram and Signify (Philips Lighting) have a significant presence in the European market, leveraging their strong R&D capabilities and extensive product portfolios to meet the region’s stringent efficiency and sustainability requirements.

Trilux (Germany), Zumtobel Group (Austria), Eaton Corporation (Irish/American), Dialight (Britain), Ledvance (Germany), and Luceco (UK) are other major players in the region’s LED lighting market.

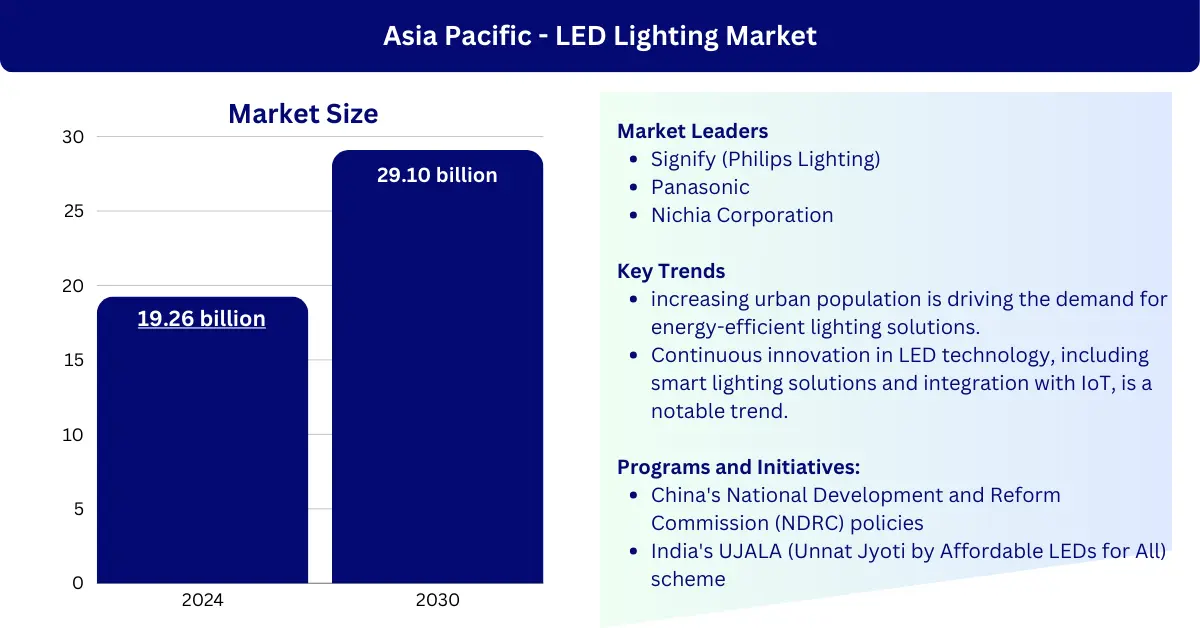

Market Size (2023): USD 19.26 Billion

The Asia Pacific LED Lighting Market is projected to grow from USD 19.26 billion in 2024 to USD 29.10 billion by 2030, with a CAGR of 7.12% during the forecast period (2024-2030).

The Asia-Pacific region is the fastest-growing market for LED lighting, driven by rapid urbanization, infrastructure development, and supportive government policies. Countries like China and India are leading this growth with large-scale projects aimed at improving energy efficiency and reducing carbon emissions.

China’s National Development and Reform Commission (NDRC) has implemented policies that promote the use of LEDs in public and commercial spaces, supported by subsidies and incentives for energy-efficient lighting.

In India, the UJALA (Unnat Jyoti by Affordable LEDs for All) scheme has successfully distributed millions of LED bulbs to households, significantly reducing energy consumption and electricity bills. The construction boom in the region, coupled with rising energy costs, is further driving the demand for LED lighting.

Local manufacturers, along with international players like Signify (Philips Lighting), Panasonic (Japan) and, Nichia Corporation (Japan) are capitalizing on these opportunities by offering a wide range of affordable and advanced LED products. Other major LED companies in this region are Crompton Greaves Consumer Electricals Ltd (CGCEL), OPPLE Lighting, OSRAM, etc.

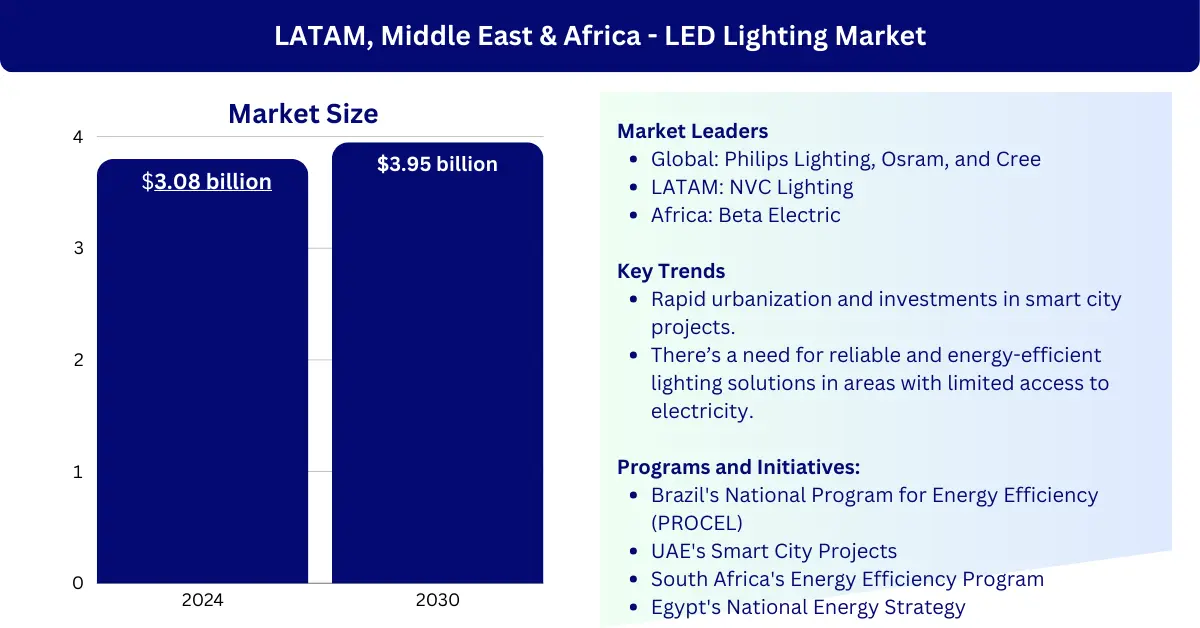

Market Size (2024): USD 3.08 billion

The Rest of the World encompasses emerging markets in Latin America, the Middle East, and Africa, where the adoption of LED lighting is gaining momentum. These regions are characterized by increasing urbanization and infrastructure development, which create significant opportunities for LED lighting solutions.

The Middle East and Africa LED Lighting Market is projected to grow from USD 3.08 billion in 2024 to USD 3.95 billion by 2030, with an expected CAGR of 4.21% during the forecast period (2024-2030).

In Latin America, Brazil’s National Program for Energy Efficiency (PROCEL) is promoting the adoption of energy-efficient technologies, including LEDs, with incentives and public campaigns. In the Middle East, countries like the UAE are investing heavily in smart city projects that include LED lighting systems to improve energy efficiency and infrastructure.

Egypt’s National Energy Strategy encourages the use of energy-efficient technologies, including LEDs, to reduce energy consumption and environmental impact.

Africa’s LED market is also growing as there is a need for reliable and energy-efficient lighting in areas with no electricity. International companies and local manufacturers are increasing their presence in these regions to cash in on the growing demand for LEDs.

For example, South Africa’s Energy Efficiency Program focuses on promoting energy-efficient lighting solutions, including LEDs, to reduce electricity consumption. Also, Kenya’s Rural Electrification Program aims to provide reliable and energy-efficient lighting solutions to rural areas, with a focus on LED technology.

Signify (Philips Lighting), Osram, Cree, and local manufacturers like NVC Lighting in Latin America and Beta Electric in Africa are increasing their presence.

The LED lighting market can be segmented into three primary product categories: LED bulbs, LED luminaires, and specialty LED lighting solutions. Each of these segments has its own unique trends, growth drivers, challenges, and key players.

LED bulbs are the most common and well known products in the LED lighting market. These bulbs replace traditional incandescent and compact fluorescent lamps (CFLs) in residential, commercial and industrial applications. Over the past 10 years LED bulb adoption has grown rapidly due to their energy efficiency, longer life and decreasing cost.

Key trends and innovations. One of the key trends in the LED bulb segment is the integration of smart technology. Smart LED bulbs can be controlled remotely via smartphones or home automation systems, users can adjust brightness, color and scheduling. This trend is strong in developed markets where smart homes are popular.

Recent studies have demonstrated that energy-efficient smart LED lighting systems offer enhanced visual comfort and a more conducive working environment while consuming less energy compared to traditional lighting systems. Also innovations in LED technology has led to development of dimmable LEDs and color changing LEDs which enhances user experience by giving more control and customization.

Despite these benefits, the higher initial cost of LED bulbs compared to traditional lighting solutions is a hurdle for some consumers especially in price sensitive markets. But the long term savings on energy bills and reduced maintenance cost usually offsets the initial investment and makes LED bulbs cost effective in the long run.

Key players in this segment are Philips, Osram, and GE Lighting, who continue to lead the market through innovation and a wide range of products.

LED Luminaires which are complete lighting units including the LED light source and the fixture are gaining popularity across all sectors. They are used in a wide range of applications from residential and commercial to industrial and outdoor. The versatility and efficiency of LED Luminaires makes them a choice for new installations and retrofit projects.

Key trends and innovations. The LED Luminaires market is driven by two main factors. Firstly, the demand for energy-efficient lighting solutions in commercial and industrial sectors is increasing due to cost savings and environmental benefits. Secondly, there is a growing focus on design and multifunctionality in residential applications. Consumers are looking for lighting solutions that not only light spaces but also enhance the overall ambiance and design of their homes.

Integrated sensors and control systems have also been developed with the advancements in LED technology which are more useful in commercial and industrial applications. These smart Luminaires can adjust lighting levels based on occupancy, daylight and other factors to optimize energy use and user comfort.

Cree, Zumtobel, and Acuity Brands are the leaders in this segment, innovating design and functionality.

Specialty LED lighting covers a wide range of applications, each with its own requirements and growth drivers. This includes automotive, horticultural, medical, UV LEDs and more.

In the automotive space, LEDs are being used for headlights, taillights, interior lighting, and indicators because of their high brightness, energy efficiency, and durability. The move to electric and autonomous vehicles is driving demand for advanced LED lighting systems that improve safety and aesthetics. Car manufacturers are investing big in LED tech to improve vehicle performance and user experience.

Horticultural lighting is another fast growing application of LED tech. LEDs are used to optimise plant growth in indoor farming and greenhouse environments by providing specific light spectra that boost photosynthesis. This is growing as urban farming and controlled environment agriculture becomes more popular driven by the need for sustainable and efficient food production methods.

Medical lighting is also benefiting from LED tech; LEDs are being used in surgical lights, examination lights, and medical devices. The precision and brightness of LEDs make them perfect for medical applications where visibility is key.

UV LEDs are used in many applications, sterilisation, water purification and forensic analysis. The ability of UV LEDs to disinfect surfaces and water without chemicals makes them a great solution for public health and safety.

Each of these specialty applications has its own opportunities and challenges. The high upfront cost of advanced LED systems can be a barrier but the long term benefits of performance and energy savings often make it worth it.

Key players in the specialty LED lighting market include companies like Nichia, Cree, and Seoul Semiconductor, which are known for their innovative solutions and extensive R&D efforts.

The application focus of the LED lighting market is diverse, encompassing residential, commercial, industrial, automotive, and outdoor lighting. Each application segment has unique requirements, growth drivers, trends, and challenges that influence the adoption and development of LED lighting solutions. This section provides an in-depth analysis of each major application area.

Market Size (2023): USD 20.17 billion

Residential lighting is one of the largest segments in the LED lighting market. Homeowners are increasingly turning to LED lighting solutions for their energy efficiency, longer lifespan, and superior light quality compared to traditional incandescent and CFL bulbs. LEDs are used in various residential settings, including living rooms, kitchens, bathrooms, and outdoor spaces such as gardens and patios.

Energy efficiency is the biggest driver of LED adoption in residential. LEDs use much less electricity than incandescent and CFL bulbs so there are big savings on energy bills. This is a major draw for environmentally aware consumers who want to reduce their carbon footprint. Many governments also offer incentives and rebates to encourage energy efficient lighting, which helps to boost the market.

However the initial higher cost of LED bulbs and fixtures can be a barrier for some homeowners, especially in developing regions. But the long term cost savings and low maintenance requirements make LEDs a good investment.

Aesthetic flexibility of LED lighting also plays a big role in residential adoption. LEDs come in various shapes, sizes and colour temperatures so homeowners can create different moods and ambiances in their living spaces.

Smart LED Adoption: A growing number of homeowners are adopting smart LED lighting solutions. For instance, the integration of Philips Hue smart bulbs with Amazon Alexa and Google Home has enabled seamless voice control and automation, enhancing user convenience and energy management.

Market Size (2023): USD 48.9 billion

Commercial lighting encompasses a wide range of settings, including offices, retail spaces, hospitals, schools, and hotels. The demand for LED lighting in commercial applications is driven by the need for energy efficiency, cost savings, and enhanced lighting quality. LEDs provide consistent and high-quality illumination, making them ideal for environments where visibility and comfort are critical.

Despite the numerous benefits, there are challenges in the commercial LED lighting market. High upfront costs and the complexity of retrofitting existing lighting systems can be significant barriers. However, many businesses are overcoming these challenges through phased implementation and taking advantage of financial incentives and rebates offered by governments and utility companies.

Corporate Offices: Many corporations have undertaken LED retrofit projects to improve energy efficiency. For example, the retrofit of the Empire State Building with LED lighting resulted in significant energy savings and enhanced lighting quality.

Retail Chains: Retail chains like Walmart have adopted LED lighting across their stores to reduce energy consumption and enhance the shopping experience for customers.

Market Size (2023): 305.8 million

The global Industrial LED Task Lighting market was valued at USD 305.8 million in 2023 and is projected to reach USD 416.3 million by 2030, experiencing a CAGR of 4.5% during the forecast period from 2024 to 2030.

The industrial sector uses LED lighting for various applications, including warehouses, manufacturing facilities, and large industrial complexes. LED lighting provides high-intensity illumination, which is essential for tasks that require precision and attention to detail. The robustness and durability of LEDs make them suitable for harsh industrial environments.

The initial investment in LED lighting for industrial applications can be substantial, but the long-term benefits in terms of energy savings, reduced maintenance costs, and improved operational efficiency make it a worthwhile investment.

Companies like Philips Lighting, Cree, and Eaton are key players in the industrial LED lighting market, offering a range of products designed to withstand the demands of industrial environments and deliver superior performance.

Manufacturing Plants: Many manufacturing plants have transitioned to LED lighting to improve visibility and safety on the production floor. For instance, Ford Motor Company has implemented LED lighting in its factories to enhance energy efficiency and reduce operational costs.

Warehouses: Large warehouses and distribution centers, such as those operated by Amazon, have adopted LED lighting to improve illumination and reduce energy consumption.

Market Size (2023): $18.84 billion

The automotive LED lighting market has experienced significant growth recently and was valued at $18.84 billion in 2023. Looking forward, the market is expected to continue expanding, projected to reach $30.52 billion by 2030, with a CAGR of 7.1%.

The automotive sector is a significant application area for LED lighting. LEDs are used for various lighting functions in vehicles, including headlights, taillights, interior lighting, and indicators. The advantages of LEDs, such as high brightness, energy efficiency, and long lifespan, make them ideal for automotive applications.

LED Headlights: LED headlights are becoming standard in modern vehicles due to their superior brightness and energy efficiency. They provide better visibility for drivers and enhance road safety.

Despite the higher initial costs, the long lifespan and low maintenance requirements of LEDs make them an attractive option for automotive manufacturers. Leading companies in the automotive LED lighting market include Osram, Philips Lighting, and Valeo, which are continuously developing advanced lighting solutions to meet the evolving demands of the automotive industry.

Luxury Vehicles: Luxury car manufacturers such as Audi and BMW have been early adopters of LED lighting technology, using it to enhance both functionality and aesthetics.

Electric Vehicles: The rise of electric vehicles (EVs) has further boosted the demand for energy-efficient LED lighting. Companies like Tesla incorporate advanced LED lighting systems to enhance vehicle performance and appeal.

Market Size: USD 17.96 billion

The global outdoor LED market was valued at USD 17.96 billion in 2023 and is projected to grow to USD 46.84 billion by 2030, with a compound annual growth rate (CAGR) of 17.3% from 2024 to 2030.

Outdoor lighting applications for LEDs include street lighting, landscape lighting, architectural lighting, and public spaces such as parks and sports facilities. LEDs are preferred for outdoor lighting due to their energy efficiency, durability, and ability to provide high-quality illumination.

Despite the higher initial investment, the long-term benefits of outdoor LED lighting make it a cost-effective solution. The energy savings, reduced maintenance costs, and improved performance of LEDs drive their adoption in outdoor applications. Companies like Philips Lighting, Cree, and GE Lighting are leaders in the outdoor LED lighting market, offering a range of products designed to meet the specific needs of different outdoor environments.

Smart Cities: Cities like Los Angeles and Barcelona have implemented smart LED street lighting systems to improve energy efficiency and enhance public services.

Architectural Projects: Iconic landmarks such as the Eiffel Tower and the Burj Khalifa use LED lighting to create stunning visual effects and highlight architectural features.

The competitive landscape of the global LED lighting market is characterized by the presence of numerous established players, emerging companies, and intense competition.

Key market participants are focused on strategies such as mergers and acquisitions, product innovation, partnerships, and geographical expansion to strengthen their market positions and enhance their product portfolios. This section provides a detailed analysis of the competitive landscape, highlighting major companies, their market share, strategies, and recent developments.

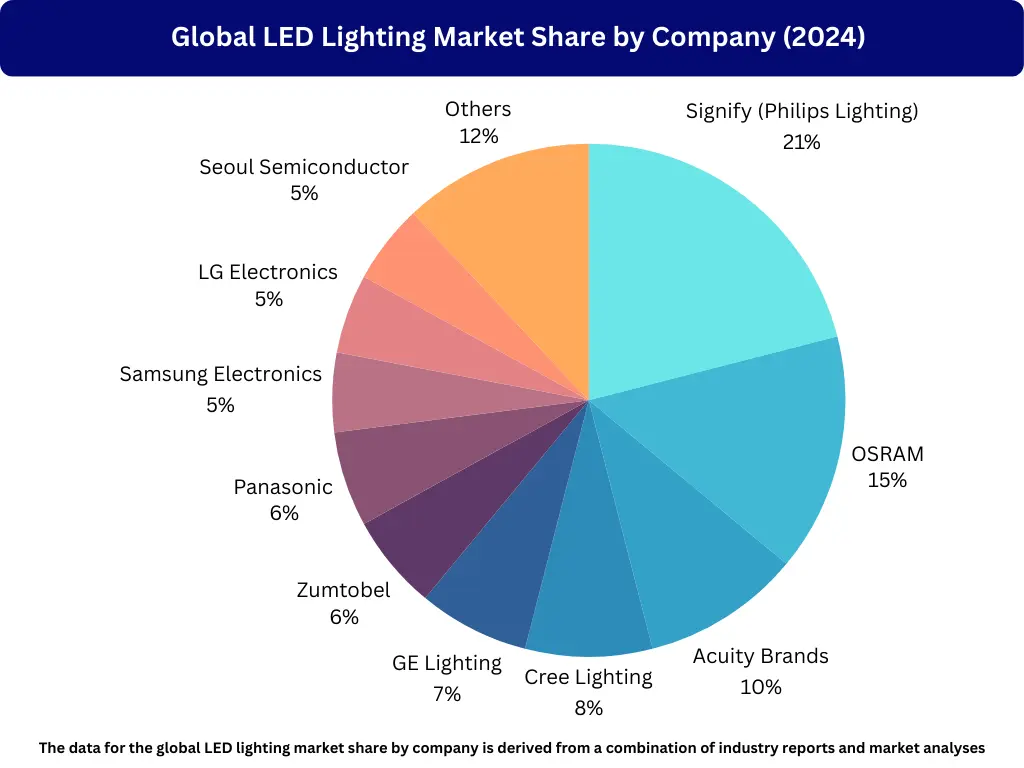

The global LED lighting market is dominated by a few key players who hold significant market shares due to their extensive product portfolios, strong brand presence, and continuous innovation. These companies include Philips Lighting (Signify), Osram, Cree Lighting, GE Lighting, and Acuity Brands.

The market share of top players in the LED lighting market is as follows:

These market shares indicate the dominant positions of these key players and their influence on the overall market dynamics. Their strong market presence is supported by their extensive product offerings, technological innovations, and strategic initiatives.

Philips Lighting, now Signify, is a global leader in LED lighting. The company was founded in Eindhoven in 1891, and in March 2018, Philips Lighting announced that the company would change its name to Signify, which became effective on 16 May 2018. Their current global headquarters are in Amsterdam, Netherlands.

They offer a wide range of products for residential, commercial, and industrial applications. Signify’s focus on innovation, especially in smart lighting and connected solutions has kept them at the top. They’ve also invested in sustainability to be carbon neutral and reduce their environmental footprint.

Signify has continued to add to their smart lighting portfolio with new products and features. The Philips Hue range now includes outdoor lighting, entertainment lighting and advanced features like voice control and geofencing. Signify has also expanded their ecosystem by integrating with major smart home platforms like Amazon Alexa, Google Assistant and Apple HomeKit.

OSRAM Licht AG is a German company and a leading LED lighting solutions provider with a strong presence in general lighting and automotive lighting. The company was founded in 1919 in Berlin with their current headquarters in the city of Munich.

They have a broad portfolio of products for various applications including smart lighting, horticultural lighting and UV LEDs. OSRAM’s focus on R&D and ability to innovate has kept them competitive in the fast changing LED market.

OSRAM has been investing in specialty lighting applications, especially in horticultural lighting and UV LEDs. They recently launched a new range of horticultural LEDs to optimise plant growth and agricultural productivity. OSRAM’s UV LED advancements has also opened up new opportunities in sterilization and water purification applications.

Acuity Brands is a North American company with its headquarters in Atlanta, Georgia. One of the oldest companies in the industry, it was founded in 1892 and is a leading provider of lighting solutions, including LED luminaires, controls and daylighting solutions.

Their broad portfolio of products serves commercial, industrial, and outdoor lighting applications. Acuity Brands’ strategic acquisitions and focus on digital lighting have given them a stronger market presence and the ability to offer integrated lighting solutions to their customers.

Acuity Brands has been acquiring companies that complements their product offerings and enhance their capabilities in smart lighting and controls. Recent acquisitions include companies that specialize in networked lighting control systems and IoT solutions, making Acuity Brands a leader in the digital lighting space.

Founded in 1987, Cree Lighting is known for high performance LED products and solutions. Their focus on energy efficient and high quality lighting products has given them a strong brand reputation.

Cree’s R&D has led to many advancements in LED technology and made it a key player in both general and specialty lighting. They have recently shifted to their new headquarters and manufacturing facility in Durham, North Carolina, US.

Cree has made big advancements in LED technology, especially in efficiency and light quality. They’ve introduced their latest range of high performance LED bulbs and fixtures which offer more energy savings and better light output. Cree’s focus on innovation has kept them competitive and able to meet the changing needs of their customers.

GE Lighting, now part of Savant Systems Inc., is a big player in the LED lighting market. It was founded in 1911, with its headquarters in East Cleveland, Ohio, USA. They offer a wide range of LED products for residential, commercial and industrial applications.

GE Lighting’s focus on smart home integration and energy-efficient solutions has kept them competitive. Their extensive distribution network and strong brand recognition has also given them an advantage in the market.

GE Lighting, under Savant Systems Inc., has been integrating its LED products with smart home technologies. Their C by GE range includes smart bulbs, switches, and sensors that can be controlled via the Cync app and integrated with popular smart home platforms. This focus on smart home integration has allowed GE Lighting to meet the growing demand for connected lighting solutions.

Zumtobel is an Austrian company based in Dornbirn, Austria. Founded in 1950, Zumtobel is a specialist in lighting solutions and services. They are well known for their architectural and design oriented lighting solutions for high end commercial and residential projects. Zumtobel’s product range includes LED luminaires, controls and lighting management systems which are famous for their quality and design.

Zumtobel has a strong presence in the European market where they are a leading lighting supplier. Their commitment to innovation and sustainability has made them a well known brand. Zumtobel work with architects and designers to develop cutting edge lighting solutions that enhance the look and feel of spaces.

Although Zumtobel has its strengths it’s mainly present in Europe so the growth potential is limited in other regions. But they have a big opportunity to expand their international presence especially in emerging markets where the demand for high end lighting is growing.

Panasonic Corporation, based in Osaka, Japan, was founded in 1918 and has grown to become a leading provider of a wide range of electronic products, including LED lighting solutions. The company’s extensive product portfolio covers residential, commercial, and industrial applications. Panasonic is known for its commitment to energy efficiency and sustainability, with many of its lighting products designed to reduce energy consumption and environmental impact.

Panasonic has a global presence with its wide distribution network. Their smart home lighting solutions, such as LED bulbs and fixtures that can be integrated with home automation systems have been well received in the market. Panasonic will continue to develop more energy-efficient products to cater to the growing demand for sustainable lighting solutions.

While Panasonic faces high competition in the consumer electronics market, its diversified portfolio and strong brand recognition provide it with significant growth opportunities. The company is particularly well-positioned to expand its presence in emerging markets where there is increasing demand for smart and energy-efficient lighting solutions.

Samsung Electronics, headquartered in Suwon, South Korea, was founded in 1969 and is a global leader in technology and electronics, including LED lighting solutions. Samsung’s extensive R&D investments and technological capabilities have positioned it as a leader in LED technology, offering innovative lighting products for various applications, including residential, commercial, and industrial lighting.

Samsung’s LED products are known for their high performance, energy efficiency, and integration with smart home systems. The company has developed advanced LED solutions that cater to the growing demand for smart lighting and IoT integration. Samsung’s global market presence and strong brand reputation further enhance its competitive position in the LED lighting market.

Despite the intense competition in the electronics sector, Samsung continues to innovate and expand its product offerings. The company’s focus on technological advancements and partnerships for smart lighting solutions provides significant growth opportunities. Samsung is also actively expanding its market presence in emerging regions, capitalizing on the increasing demand for advanced lighting solutions.

LG Electronics, based in Seoul, South Korea, was founded in 1958 and is a leading provider of consumer electronics and home appliances, including LED lighting solutions. LG’s lighting products are designed to offer high energy efficiency, superior performance, and smart home integration. The company’s strong emphasis on R&D and innovation has enabled it to develop a diverse range of lighting solutions for residential, commercial, and industrial applications.

LG’s smart lighting products, which can be controlled via smartphones and integrated with other smart home devices, have gained popularity in the market. The company’s commitment to sustainability and energy efficiency aligns with the growing consumer demand for eco-friendly lighting solutions. LG’s extensive distribution network and strong brand equity further support its market presence.

While LG faces high competition in the consumer electronics market, its focus on innovation and smart lighting provides significant growth opportunities. The company is well-positioned to expand its presence in emerging markets and continue developing innovative lighting solutions that meet the evolving needs of consumers.

![]()

Seoul Semiconductor, headquartered in Ansan, South Korea, was founded in 1987 and is a leading provider of advanced LED technology. The company is known for its strong focus on innovation and its extensive patent portfolio, which includes numerous proprietary technologies in the LED lighting industry. Seoul Semiconductor offers a wide range of LED products for residential, commercial, industrial, automotive, and specialty lighting applications.

Seoul Semiconductor’s commitment to R&D has led to the development of cutting-edge LED solutions that offer high efficiency, superior performance, and long lifespans. The company’s products are used in various applications, including high-brightness LEDs, UV LEDs, and smart lighting solutions. Seoul Semiconductor’s strong R&D capabilities and innovation-driven approach have positioned it as a leader in the LED lighting market.

Despite its strengths, Seoul Semiconductor has limited market diversification and may face supply chain challenges. However, the company has significant opportunities to expand into new geographic markets and form partnerships for smart and specialty lighting solutions. The ongoing advancements in LED technology and increasing demand for energy-efficient lighting provide a favorable environment for Seoul Semiconductor’s growth.

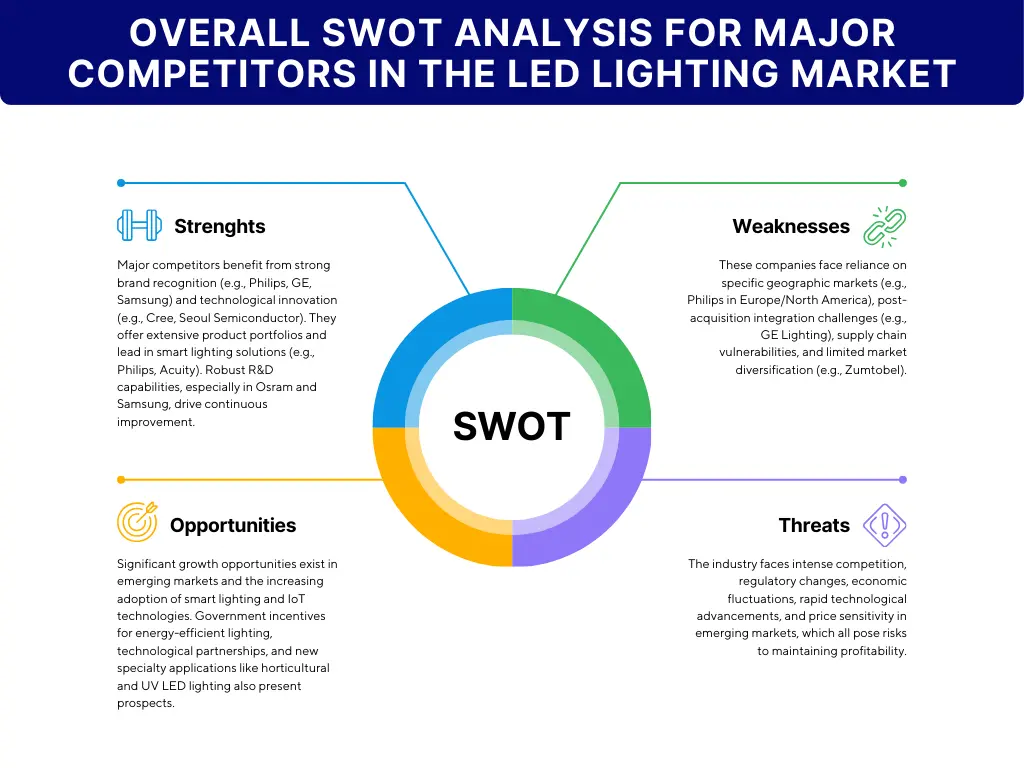

This SWOT analysis of major competitors in the LED lighting market provides insights into their strengths, weaknesses, opportunities, and threats.

Company | Strengths | Weaknesses | Opportunities | Threats |

Philips Lighting (Signify) | Strong brand recognition, extensive product portfolio, leadership in smart lighting solutions, significant investments in sustainability. | High reliance on European and North American markets, potential challenges in rapidly evolving technology landscape. | Expansion into emerging markets, development of innovative smart lighting products, partnerships for technological advancements. | Intense competition, regulatory changes, economic fluctuations impacting consumer spending. |

Osram | Strong R&D capabilities, diversified product range, leadership in automotive lighting, robust presence in specialty lighting segments. | High exposure to the automotive sector, potential vulnerability to market fluctuations in specific segments. | Growth in horticultural and UV LED applications, expansion in emerging markets, strategic acquisitions to enhance product offerings. | Competitive pressures, technological obsolescence, regulatory challenges. |

Cree Lighting | Technological innovation, high-performance products, strong focus on energy efficiency, leadership in specialty lighting. | Limited market diversification, potential supply chain vulnerabilities. | Advancements in LED technology, expansion into new geographic markets, partnerships for smart lighting solutions. | Intense competition, price sensitivity in emerging markets, economic uncertainties. |

GE Lighting | Strong brand equity, comprehensive product range, emphasis on smart home integration, extensive distribution network. | Integration challenges post-acquisition, potential dependency on specific markets. | Growth in smart home lighting, expansion in emerging markets, development of innovative energy-efficient products. | Competitive landscape, regulatory changes, market volatility. |

Acuity Brands | Broad product portfolio, leadership in digital lighting solutions, strategic acquisitions, strong presence in commercial and industrial segments. | High reliance on North American market, potential integration challenges from acquisitions. | Expansion in international markets, growth in smart lighting and controls, partnerships for technological innovation. | Economic downturns, competitive pressures, regulatory uncertainties. |

Zumtobel | Strong focus on architectural and design-oriented lighting solutions, robust European market presence, innovative product design. | Limited market presence outside Europe, high dependency on European market. | Expansion in international markets, partnerships with architectural firms, innovation in sustainable lighting solutions. | Intense competition, economic fluctuations in Europe, regulatory changes. |

Panasonic | Strong brand recognition, diversified product portfolio, extensive distribution network, focus on energy-efficient solutions. | High competition in consumer electronics, potential over-reliance on Asian markets. | Growth in smart home lighting, expansion in emerging markets, innovation in energy-efficient products. | Competitive pressures, economic volatility, regulatory changes. |

Samsung Electronics | Strong technological capabilities, leadership in LED technology, extensive R&D investments, global market presence. | High competition in the electronics sector, potential supply chain vulnerabilities. | Innovation in smart lighting and IoT integration, expansion in emerging markets, partnerships for technological advancements. | Intense competition, economic fluctuations, regulatory challenges. |

LG Electronics | Strong brand recognition, diversified product portfolio, focus on smart home integration, significant R&D investments. | High competition in consumer electronics, potential dependency on specific markets. | Growth in smart home lighting, expansion in emerging markets, innovation in energy-efficient and smart products. | Competitive landscape, economic volatility, regulatory uncertainties. |

Seoul Semiconductor | Leadership in advanced LED technology, strong focus on innovation, extensive patent portfolio, robust R&D capabilities. | Limited market diversification, potential supply chain issues. | Advancements in LED technology, expansion into new geographic markets, partnerships for smart and specialty lighting solutions. | Intense competition, price sensitivity in emerging markets, economic uncertainties. |

The competitive strategies employed by key players in the LED lighting market can be broadly categorized into the following:

The market dynamics of the global LED lighting market are influenced by various factors, including market drivers, restraints, opportunities, technological advancements, and regulatory impacts. Understanding these dynamics is crucial for stakeholders to navigate the market effectively and capitalize on growth opportunities.

Energy Efficiency: One of the primary drivers of the LED lighting market is the superior energy efficiency of LEDs compared to traditional lighting technologies such as incandescent and fluorescent bulbs. LEDs convert a higher percentage of electricity into light, resulting in significantly lower energy consumption. This energy efficiency translates into substantial cost savings on electricity bills for consumers and businesses. As energy costs continue to rise, the demand for energy-efficient lighting solutions like LEDs is expected to grow.

Environmental Concerns: Increasing awareness of environmental issues and the need to reduce carbon footprints have driven the adoption of LED lighting. LEDs do not contain hazardous substances like mercury, which is present in fluorescent lights, and they have a lower carbon footprint due to their energy efficiency. As governments and organizations worldwide strive to meet sustainability goals and reduce greenhouse gas emissions, the adoption of environmentally friendly LED lighting solutions is expected to accelerate.

Government Regulations and Incentives: Governments around the world have implemented regulations and incentives to promote energy-efficient lighting solutions. Policies such as the European Union’s Energy Performance of Buildings Directive and the U.S. Department of Energy’s initiatives have set stringent energy efficiency standards that favor the adoption of LEDs. Additionally, many governments offer subsidies, tax rebates, and other incentives to encourage consumers and businesses to switch to LED lighting.

Technological Advancements: Continuous advancements in LED technology have led to improvements in performance, efficiency, and affordability. Innovations such as smart lighting systems, which can be controlled remotely and integrated with home automation systems, have enhanced the appeal of LED products. The development of new materials and manufacturing processes has also reduced the cost of LEDs, making them more accessible to a broader range of consumers.

Long Lifespan and Low Maintenance: LEDs have a much longer operational life compared to traditional lighting solutions. They can last up to 25,000 to 50,000 hours, significantly reducing the frequency of replacements. This long lifespan, combined with their durability and low maintenance requirements, makes LEDs an attractive option for both residential and commercial applications. The reduced need for frequent replacements also translates into lower maintenance costs for businesses and public infrastructure.

High Initial Costs: Despite the long-term cost savings associated with LED lighting, the higher initial cost of LED products compared to traditional lighting solutions can be a barrier for some consumers, particularly in developing regions. The upfront investment required for purchasing LED bulbs and fixtures can deter price-sensitive consumers and small businesses from making the switch.

Technical Challenges: While LED technology has advanced significantly, there are still technical challenges that need to be addressed. Issues such as heat dissipation, color rendering, and light distribution can impact the performance and quality of LED lighting. Manufacturers must continue to innovate and improve their products to overcome these technical challenges and meet the diverse needs of consumers and businesses.

Compatibility with Existing Systems: Retrofitting existing lighting systems with LED solutions can be complex and costly. In some cases, LED products may not be compatible with existing fixtures or control systems, requiring additional investments in infrastructure upgrades. This can be a significant barrier for commercial and industrial facilities with extensive lighting installations.

Emerging Markets: Emerging markets in regions such as Asia-Pacific, Latin America, and Africa present significant growth opportunities for the LED lighting market. Rapid urbanization, infrastructure development, and rising energy costs in these regions drive the demand for energy-efficient lighting solutions. Governments in emerging markets are also implementing policies and incentives to promote the adoption of LEDs, further boosting market growth.

Smart Lighting Solutions: The integration of LEDs with smart lighting systems offers new growth opportunities. Smart lighting solutions can be controlled remotely, programmed for specific lighting schedules, and integrated with other smart home devices. These features enhance energy efficiency, convenience, and user experience. As the adoption of smart home technology continues to rise, the demand for smart LED lighting solutions is expected to grow.

Technological Innovations: Ongoing technological innovations in LED lighting present opportunities for market expansion. Developments such as Li-Fi technology, which uses LED lights for wireless communication, and advancements in horticultural lighting, UV LEDs, and automotive lighting open new avenues for growth. Companies that invest in R&D and stay at the forefront of technological advancements are well-positioned to capitalize on these opportunities.

Smart Lighting: Smart lighting technology has revolutionized the LED lighting market. Smart LEDs can be controlled via smartphones, voice assistants, or home automation systems, offering users greater control and customization. Features such as dimming, color changing, and scheduling enhance user experience and energy efficiency. Smart lighting systems are particularly popular in residential and commercial applications, where they provide convenience, flexibility, and cost savings.

Advanced Materials: Advancements in materials science have led to the development of more efficient and durable LED products. New materials used in LED chips and phosphors have improved light quality, color rendering, and thermal management. These advancements have also contributed to reducing the cost of LED production, making LED lighting more affordable for consumers and businesses.

Integration with IoT: The integration of LED lighting with the Internet of Things (IoT) has opened new possibilities for connected and intelligent lighting systems. IoT-enabled LEDs can communicate with other devices and systems, enabling advanced features such as occupancy sensing, daylight harvesting, and energy management. These smart features enhance energy efficiency and user comfort, making IoT integration a key trend in the LED lighting market.

Energy Efficiency Standards: Global and regional energy efficiency standards have a significant impact on the LED lighting market. Regulations such as the European Union’s Ecodesign Directive and the U.S. Energy Star program set minimum energy efficiency requirements for lighting products. Compliance with these standards is mandatory for manufacturers, driving the adoption of energy-efficient LED lighting solutions.

Environmental Regulations: Environmental regulations aimed at reducing carbon emissions and promoting sustainable practices are also influencing the LED lighting market. Policies that ban or phase out inefficient lighting technologies, such as incandescent and halogen bulbs, create a favorable environment for LED adoption. Manufacturers must ensure that their products meet environmental standards and contribute to sustainability goals.

Incentives and Subsidies: Government incentives and subsidies play a crucial role in promoting the adoption of LED lighting. Financial incentives such as rebates, tax credits, and grants reduce the initial cost burden for consumers and businesses, making LEDs more attractive. These incentives encourage the transition to energy-efficient lighting solutions and support market growth.

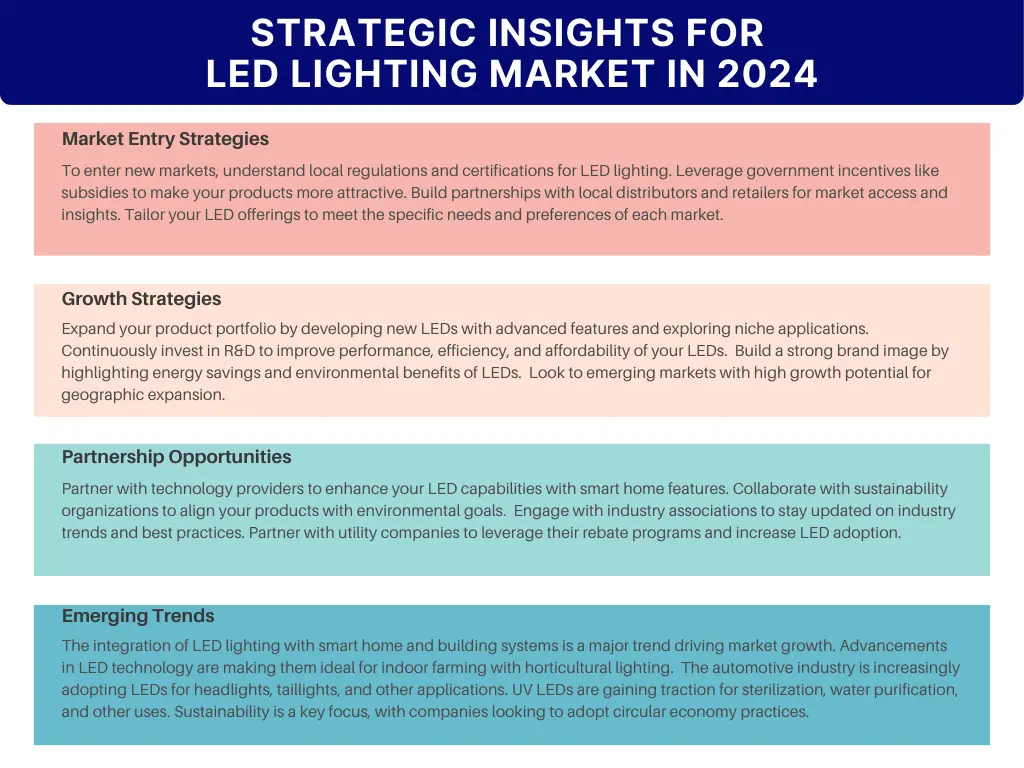

The strategic insights for the global LED lighting market are crucial for businesses, investors, and other stakeholders to navigate the market effectively and capitalize on growth opportunities. This section provides detailed recommendations and strategies for market entry, growth, and partnerships, along with insights into emerging trends and future directions.

The global LED lighting market is on a robust growth trajectory, driven by technological advancements, energy efficiency awareness, and supportive regulatory frameworks. Projected to grow from USD 60 billion in 2023 to USD 147 billion by 2028, the market’s expansion is fueled by diverse applications in residential, commercial, industrial, automotive, and outdoor settings.

Key players like Signify, Osram, Cree Lighting, GE Lighting, and Acuity Brands lead the competitive landscape, leveraging innovation, strategic partnerships, and geographical expansion. Despite challenges such as high initial costs and technical issues, the market’s potential is vast, especially with emerging opportunities in smart lighting, horticultural lighting, and UV LEDs.

Strategic insights emphasize the importance of understanding local regulations, investing in R&D, and focusing on sustainability. Companies that prioritize these strategies are well-positioned to capitalize on the market’s growth and drive the future of LED lighting.

In summary, the LED lighting market offers significant opportunities for growth and innovation. By embracing technological advancements and sustainable practices, companies can navigate the dynamic market landscape and achieve long-term success. The future of lighting is bright, with LEDs leading the way.

Invest in Innovation: Focus on R&D to stay ahead of technological advancements and market trends.

Expand into Emerging Markets: Capitalize on high growth potential in regions like Asia-Pacific and Latin America.

Build Strategic Partnerships: Collaborate with tech companies and sustainability organizations to enhance market presence and drive growth.

Future Outlook: The LED lighting market is expected to maintain a robust growth trajectory fueled by ongoing technological innovations, supportive regulatory frameworks, and increasing consumer demand for energy-efficient solutions.

Data Sources:

Explore guide to built-in shelf lighting. Learn about LED strips, puck lights, recessed lights, tape lights, and their installation tips for perfect ambiance.

Explore the Global LED Lighting Market Report 2024 for insights on trends, growth drivers, and key players in the industry, including product segment and geographic

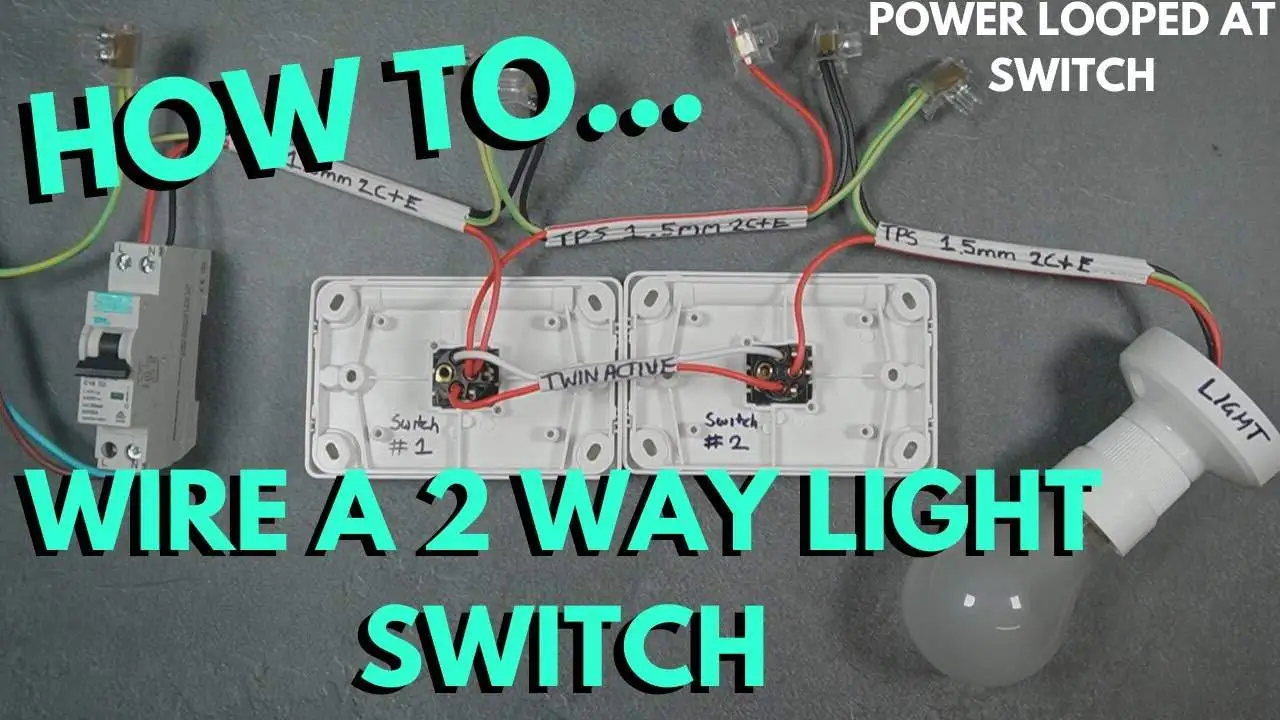

Learn how to wire a 2-way light switch effectively. This guide covers essential tools, step-by-step instructions, and safety measures for an installation.

| This LED Industry Research Report Is Worth 10,000 Dollars!Want to get reliable industry data to support your LED business planning? In this report, you will:

*Submit your email to download this file. Your personal info will not be shared to any 3rd-party person or organizations. |

WhatsApp us

*We respect your confidentiality and all information are protected.